| From | Comptroller Brad Lander <[email protected]> |

| Subject | The high-rising cost of NYC’s most unaffordable tax exemption |

| Date | March 19, 2022 2:18 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Today, the 421-a program is a towering boondoggle—costing our city $1.77 billion this year in foregone taxes.

Dear New Yorkers,

Over the years, New York’s property tax system has become a patchwork of exemptions and abatements responding to changes in the housing market. The result is a hard-to-understand system that taxes homeowners in Park Slope at lower rates than those in Southeast Queens, and rental properties nearly double the rate of condo buildings. In the words of the NYC Commission on Property Tax Reform last year, our system is “opaque,” “arcane,” and “inequitable.”

The largest of those exemptions is 421-a. Established in 1971, the 421-a tax exemption was designed to spur housing development at a time of disinvestment. Today, the 421-a program is a towering boondoggle—costing our city $1.77 billion this year in foregone taxes and delivering only a small handful of actually affordable units in return.

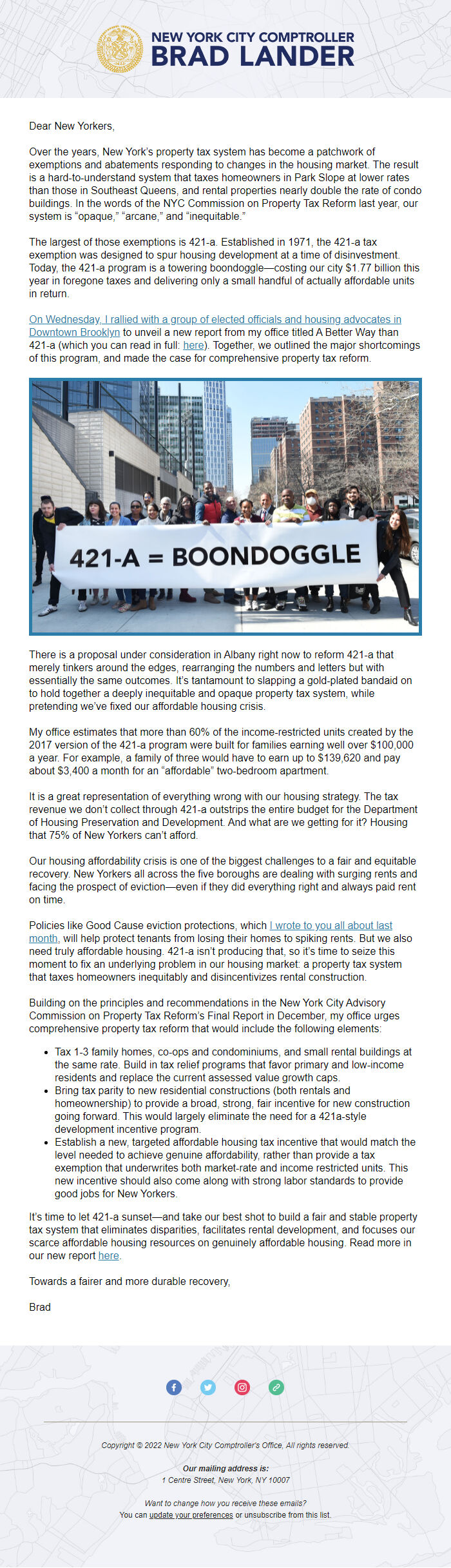

On Wednesday, I rallied with a group of elected officials and housing advocates in Downtown Brooklyn ([link removed]) to unveil a new report from my office titled A Better Way than 421-a (which you can read in full: here ([link removed]) ). Together, we outlined the major shortcomings of this program, and made the case for comprehensive property tax reform.

[link removed]

There is a proposal under consideration in Albany right now to reform 421-a that merely tinkers around the edges, rearranging the numbers and letters but with essentially the same outcomes. It’s tantamount to slapping a gold-plated bandaid on to hold together a deeply inequitable and opaque property tax system, while pretending we’ve fixed our affordable housing crisis.

My office estimates that more than 60% of the income-restricted units created by the 2017 version of the 421-a program were built for families earning well over $100,000 a year. For example, a family of three would have to earn up to $139,620 and pay about $3,400 a month for an “affordable” two-bedroom apartment.

It is a great representation of everything wrong with our housing strategy. The tax revenue we don’t collect through 421-a outstrips the entire budget for the Department of Housing Preservation and Development. And what are we getting for it? Housing that 75% of New Yorkers can’t afford.

Our housing affordability crisis is one of the biggest challenges to a fair and equitable recovery. New Yorkers all across the five boroughs are dealing with surging rents and facing the prospect of eviction—even if they did everything right and always paid rent on time.

Policies like Good Cause eviction protections, which I wrote to you all about last month ([link removed]) , will help protect tenants from losing their homes to spiking rents. But we also need truly affordable housing. 421-a isn’t producing that, so it’s time to seize this moment to fix an underlying problem in our housing market: a property tax system that taxes homeowners inequitably and disincentivizes rental construction.

Building on the principles and recommendations in the New York City Advisory Commission on Property Tax Reform’s Final Report in December, my office urges comprehensive property tax reform that would include the following elements:

* Tax 1-3 family homes, co-ops and condominiums, and small rental buildings at the same rate. Build in tax relief programs that favor primary and low-income residents and replace the current assessed value growth caps.

* Bring tax parity to new residential constructions (both rentals and homeownership) to provide a broad, strong, fair incentive for new construction going forward. This would largely eliminate the need for a 421a-style development incentive program.

* Establish a new, targeted affordable housing tax incentive that would match the level needed to achieve genuine affordability, rather than provide a tax exemption that underwrites both market-rate and income restricted units. This new incentive should also come along with strong labor standards to provide good jobs for New Yorkers.

It’s time to let 421-a sunset—and take our best shot to build a fair and stable property tax system that eliminates disparities, facilitates rental development, and focuses our scarce affordable housing resources on genuinely affordable housing. Read more in our new report here ([link removed]) .

Towards a fairer and more durable recovery,

Brad

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Link ([link removed])

** New York City Comptroller's Office ([link removed])

Copyright © 2022 New York City Comptroller's Office, All rights reserved.

Our mailing address is:

1 Centre Street, New York, NY 10007

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Dear New Yorkers,

Over the years, New York’s property tax system has become a patchwork of exemptions and abatements responding to changes in the housing market. The result is a hard-to-understand system that taxes homeowners in Park Slope at lower rates than those in Southeast Queens, and rental properties nearly double the rate of condo buildings. In the words of the NYC Commission on Property Tax Reform last year, our system is “opaque,” “arcane,” and “inequitable.”

The largest of those exemptions is 421-a. Established in 1971, the 421-a tax exemption was designed to spur housing development at a time of disinvestment. Today, the 421-a program is a towering boondoggle—costing our city $1.77 billion this year in foregone taxes and delivering only a small handful of actually affordable units in return.

On Wednesday, I rallied with a group of elected officials and housing advocates in Downtown Brooklyn ([link removed]) to unveil a new report from my office titled A Better Way than 421-a (which you can read in full: here ([link removed]) ). Together, we outlined the major shortcomings of this program, and made the case for comprehensive property tax reform.

[link removed]

There is a proposal under consideration in Albany right now to reform 421-a that merely tinkers around the edges, rearranging the numbers and letters but with essentially the same outcomes. It’s tantamount to slapping a gold-plated bandaid on to hold together a deeply inequitable and opaque property tax system, while pretending we’ve fixed our affordable housing crisis.

My office estimates that more than 60% of the income-restricted units created by the 2017 version of the 421-a program were built for families earning well over $100,000 a year. For example, a family of three would have to earn up to $139,620 and pay about $3,400 a month for an “affordable” two-bedroom apartment.

It is a great representation of everything wrong with our housing strategy. The tax revenue we don’t collect through 421-a outstrips the entire budget for the Department of Housing Preservation and Development. And what are we getting for it? Housing that 75% of New Yorkers can’t afford.

Our housing affordability crisis is one of the biggest challenges to a fair and equitable recovery. New Yorkers all across the five boroughs are dealing with surging rents and facing the prospect of eviction—even if they did everything right and always paid rent on time.

Policies like Good Cause eviction protections, which I wrote to you all about last month ([link removed]) , will help protect tenants from losing their homes to spiking rents. But we also need truly affordable housing. 421-a isn’t producing that, so it’s time to seize this moment to fix an underlying problem in our housing market: a property tax system that taxes homeowners inequitably and disincentivizes rental construction.

Building on the principles and recommendations in the New York City Advisory Commission on Property Tax Reform’s Final Report in December, my office urges comprehensive property tax reform that would include the following elements:

* Tax 1-3 family homes, co-ops and condominiums, and small rental buildings at the same rate. Build in tax relief programs that favor primary and low-income residents and replace the current assessed value growth caps.

* Bring tax parity to new residential constructions (both rentals and homeownership) to provide a broad, strong, fair incentive for new construction going forward. This would largely eliminate the need for a 421a-style development incentive program.

* Establish a new, targeted affordable housing tax incentive that would match the level needed to achieve genuine affordability, rather than provide a tax exemption that underwrites both market-rate and income restricted units. This new incentive should also come along with strong labor standards to provide good jobs for New Yorkers.

It’s time to let 421-a sunset—and take our best shot to build a fair and stable property tax system that eliminates disparities, facilitates rental development, and focuses our scarce affordable housing resources on genuinely affordable housing. Read more in our new report here ([link removed]) .

Towards a fairer and more durable recovery,

Brad

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Link ([link removed])

** New York City Comptroller's Office ([link removed])

Copyright © 2022 New York City Comptroller's Office, All rights reserved.

Our mailing address is:

1 Centre Street, New York, NY 10007

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Message Analysis

- Sender: Brad Lander

- Political Party: Democratic

- Country: United States

- State/Locality: New York New York City

- Office: City Council

-

Email Providers:

- MailChimp