Email

The Weekly Roundup from the Office of Rick Barnes

| From | Tarrant County Tax Office <[email protected]> |

| Subject | The Weekly Roundup from the Office of Rick Barnes |

| Date | January 21, 2026 8:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

News and Updates from the Office of Rick Barnes ([link removed]) .

[link removed]

United by a shared commitment to excellence, we are a team of dedicated professionals who serve with joy, respect, and integrity.

What’s In Store This Week:

Property Tax Reminders

New ID Requirements for Registration

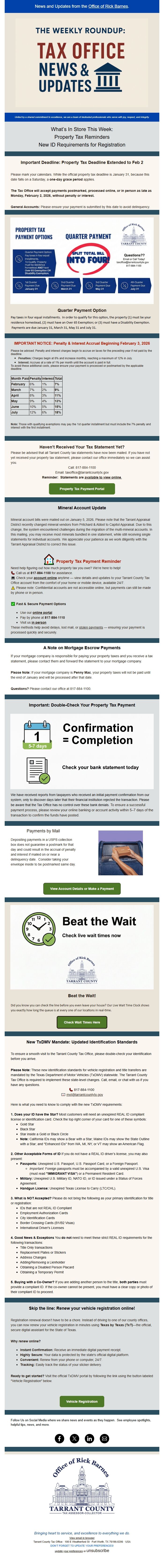

Important Deadline: Property Tax Deadline Extended to Feb 2

Please mark your calendars. While the official property tax deadline is January 31, because this date falls on a Saturday, a one-day grace period applies.

The Tax Office will accept payments postmarked, processed online, or in person as late as Monday, February 2, 2026, without penalty or interest.

General Accounts: Please ensure your payment is submitted by this date to avoid delinquency.

Quarter Payment Option

Pay taxes in four equal installments. In order to qualify for this option, the property (1) must be your residence homestead, (2) must have an Over 65 Exemption; or (3) must have a Disability Exemption. Payments are due January 31, March 31, May 31 and July 31.

** IMPORTANT NOTICE: Penalty & Interest Accrual Beginning February 3, 2026

------------------------------------------------------------

Please be advised: Penalty and interest charges begin to accrue on taxes for the preceding year if not paid by the deadline.

* Penalties: Charges begin at 6% and increase monthly, reaching a maximum of 12% in July.

* Interest: Accrues at a rate of 1% per month until the account is paid in full.

To avoid these additional costs, please ensure your payment is processed or postmarked by the applicable deadline.

Month Paid

Penalty

Interest

Total

February

6%

1%

7%

March

7%

2%

9%

April

8%

3%

11%

May

9%

4%

13%

June

10%

5%

15%

July

12%

6%

18%

Note: Those with qualifying exemptions may pay the 1st quarter installment but must include the 7% penalty and interest with the first installment.

Haven’t Received Your Tax Statement Yet?

Please be advised that all Tarrant County tax statements have now been mailed. If you have not yet received your property tax statement, please contact our office immediately so we can assist you.

Call: 817-884-1100

Email: [email protected]

Reminder: Statements are available to view online. ([link removed])

Property Tax Payment Portal ([link removed])

** Mineral Account Update

------------------------------------------------------------

Mineral account bills were mailed out on January 5, 2026. Please note that the Tarrant Appraisal District recently changed mineral vendors from Pritchard & Abbot to Capitol Appraisal. Due to this change, the system encountered challenges during the migration of the multi-mineral accounts. In this mailing, you may receive most minerals bundled in one statement, while still receiving single statements for individual accounts. We appreciate your patience as we work diligently with the Tarrant Appraisal District to correct this issue.

** 🏠 Property Tax Payment Reminder

------------------------------------------------------------

Need help figuring out how much property tax you owe? We’re here to help!

📞 Call us at 817‑884‑1100 for assistance.

💻 Check your account online ([link removed]) anytime — view details and updates to your Tarrant County Tax Office account from the comfort of your home or mobile device, available 24/7.

⚠️ Please note: Confidential accounts are not accessible online, but payments can still be made by phone or in person.

✅ Fast & Secure Payment Options

* Use our online portal ([link removed])

* Pay by phone at 817‑884‑1110

* Visit us in person ([link removed])

These methods help avoid delays, lost mail, or stolen payments ([link removed]) — ensuring your payment is processed quickly and securely.

** A Note on Mortgage Escrow Payments

------------------------------------------------------------

If your mortgage company is responsible for paying your property taxes and you receive a tax statement, please contact them and forward the statement to your mortgage company.

Please Note: If your mortgage company is Penny Mac, your property taxes will not be paid until the end of January and will be processed after that date.

Questions? Please contact our office at 817-884-1100.

** Important: Double-Check Your Property Tax Payment

------------------------------------------------------------

We have received reports from taxpayers who received an initial payment confirmation from our system, only to discover days later that their financial institution rejected the transaction. Please be aware that the Tax Office has no control over these bank denials. To ensure a successful payment process, please review your online banking or account activity within 5–7 days of the transaction to confirm the funds have posted.

Payments by Mail

Depositing payments in a USPS collection box does not guarantee a postmark for that day and could result in the accrual of penalty and interest if mailed on or near a delinquency date. Consider taking your envelope inside to be postmarked same day.

View Account Details or Make a Payment ([link removed])

Beat the Wait!

Did you know you can check the line before you even leave your house? Our Live Wait Time Clock shows you exactly how long the queue is at every one of our locations in real-time.

Check Wait Times Here ([link removed])

New TxDMV Mandate: Updated Identification Standards

To ensure a smooth visit to the Tarrant County Tax Office, please double-check your identification before you arrive.

Please Note: These new identification standards for vehicle registration and title transfers are mandated by the Texas Department of Motor Vehicles (TxDMV) statewide. The Tarrant County Tax Office is required to implement these state-level changes. Call, email, or chat with us if you have any questions.

📞 817-884-1100

📧 [email protected] (mailto:[email protected])

Here is what you need to know to comply with the new TxDMV requirements:

1. Does your ID have the Star? Most customers will need an unexpired REAL ID compliant license or identification card. Check the top right corner of your card for one of these symbols:

* Gold Star

* Black Star

* Star inside a Gold or Black Circle

* Note: California IDs may show a Bear with a Star; Maine IDs may show the State Outline with a Star; and "Enhanced IDs" from WA, MI, NY, or VT may show an American Flag.

2. Other Acceptable Forms of ID If you do not have a REAL ID driver’s license, you may also present:

* Passports: Unexpired U.S. Passport, U.S. Passport Card, or a Foreign Passport.

+ Important: Foreign passports must be accompanied by a valid unexpired U.S. Visa (must read "IMMIGRANT VISA") or a Permanent Resident Card.

* Military: Unexpired U.S. Military ID, NATO ID, or ID issued under a Status of Forces Agreement.

* Handgun License: Unexpired Texas License to Carry (LTC/CHL).

3. What is NOT Accepted? Please do not bring the following as your primary identification for title or registration:

* IDs that are not REAL ID Compliant

* Employment Authorization Cards

* City Identification Cards

* Border Crossing Cards (B1/B2 Visas)

* International Driver's Licenses

4. Good News & Exceptions You do not need to meet these strict REAL ID requirements for the following transactions:

* Title Only transactions

* Replacement Plates or Stickers

* Address Changes

* Adding/Removing a Lienholder

* Obtaining a Disabled Person Placard

* Obtaining a Temporary Permit

5. Buying with a Co-Owner? If you are adding another person to the title, both parties must provide a compliant ID. If the co-owner cannot be present, you must have a clear copy or photo of their compliant ID to proceed.

** Skip the line: Renew your vehicle registration online!

------------------------------------------------------------

Registration renewal doesn’t have to be a chore. Instead of driving to one of our county offices, you can now renew your vehicle registration in minutes using Texas by Texas (TxT)—the official, secure digital assistant for the State of Texas.

Why renew online?

* Instant Confirmation: Receive an immediate digital payment receipt.

* Highly Secure: Your data is protected by the state's official digital platform.

* Convenient: Renew from your phone or computer, 24/7.

* Tracking: Easily track the status of your sticker delivery.

Ready to get started? Visit the official TxDMV portal by following the link using the button labeled "Vehicle Registration" below.

Vehicle Registration ([link removed])

Follow Us on Social Media where we share news and events as they happen. See employee spotlights, helpful tips, news, and more.

[link removed]

[link removed]

[link removed]

mailto:[email protected]

[link removed]

Bringing heart to service, and excellence to everything we do.

View email in browser ([link removed])

Tarrant County Tax Office . 100 E Weatherford St . Fort Worth, TX 76196-0206 . USA

DON’T FORGET TO UPDATE YOUR PREFERENCES!

update your preferences ([link removed]) or unsubscribe ([link removed])

[link removed]

United by a shared commitment to excellence, we are a team of dedicated professionals who serve with joy, respect, and integrity.

What’s In Store This Week:

Property Tax Reminders

New ID Requirements for Registration

Important Deadline: Property Tax Deadline Extended to Feb 2

Please mark your calendars. While the official property tax deadline is January 31, because this date falls on a Saturday, a one-day grace period applies.

The Tax Office will accept payments postmarked, processed online, or in person as late as Monday, February 2, 2026, without penalty or interest.

General Accounts: Please ensure your payment is submitted by this date to avoid delinquency.

Quarter Payment Option

Pay taxes in four equal installments. In order to qualify for this option, the property (1) must be your residence homestead, (2) must have an Over 65 Exemption; or (3) must have a Disability Exemption. Payments are due January 31, March 31, May 31 and July 31.

** IMPORTANT NOTICE: Penalty & Interest Accrual Beginning February 3, 2026

------------------------------------------------------------

Please be advised: Penalty and interest charges begin to accrue on taxes for the preceding year if not paid by the deadline.

* Penalties: Charges begin at 6% and increase monthly, reaching a maximum of 12% in July.

* Interest: Accrues at a rate of 1% per month until the account is paid in full.

To avoid these additional costs, please ensure your payment is processed or postmarked by the applicable deadline.

Month Paid

Penalty

Interest

Total

February

6%

1%

7%

March

7%

2%

9%

April

8%

3%

11%

May

9%

4%

13%

June

10%

5%

15%

July

12%

6%

18%

Note: Those with qualifying exemptions may pay the 1st quarter installment but must include the 7% penalty and interest with the first installment.

Haven’t Received Your Tax Statement Yet?

Please be advised that all Tarrant County tax statements have now been mailed. If you have not yet received your property tax statement, please contact our office immediately so we can assist you.

Call: 817-884-1100

Email: [email protected]

Reminder: Statements are available to view online. ([link removed])

Property Tax Payment Portal ([link removed])

** Mineral Account Update

------------------------------------------------------------

Mineral account bills were mailed out on January 5, 2026. Please note that the Tarrant Appraisal District recently changed mineral vendors from Pritchard & Abbot to Capitol Appraisal. Due to this change, the system encountered challenges during the migration of the multi-mineral accounts. In this mailing, you may receive most minerals bundled in one statement, while still receiving single statements for individual accounts. We appreciate your patience as we work diligently with the Tarrant Appraisal District to correct this issue.

** 🏠 Property Tax Payment Reminder

------------------------------------------------------------

Need help figuring out how much property tax you owe? We’re here to help!

📞 Call us at 817‑884‑1100 for assistance.

💻 Check your account online ([link removed]) anytime — view details and updates to your Tarrant County Tax Office account from the comfort of your home or mobile device, available 24/7.

⚠️ Please note: Confidential accounts are not accessible online, but payments can still be made by phone or in person.

✅ Fast & Secure Payment Options

* Use our online portal ([link removed])

* Pay by phone at 817‑884‑1110

* Visit us in person ([link removed])

These methods help avoid delays, lost mail, or stolen payments ([link removed]) — ensuring your payment is processed quickly and securely.

** A Note on Mortgage Escrow Payments

------------------------------------------------------------

If your mortgage company is responsible for paying your property taxes and you receive a tax statement, please contact them and forward the statement to your mortgage company.

Please Note: If your mortgage company is Penny Mac, your property taxes will not be paid until the end of January and will be processed after that date.

Questions? Please contact our office at 817-884-1100.

** Important: Double-Check Your Property Tax Payment

------------------------------------------------------------

We have received reports from taxpayers who received an initial payment confirmation from our system, only to discover days later that their financial institution rejected the transaction. Please be aware that the Tax Office has no control over these bank denials. To ensure a successful payment process, please review your online banking or account activity within 5–7 days of the transaction to confirm the funds have posted.

Payments by Mail

Depositing payments in a USPS collection box does not guarantee a postmark for that day and could result in the accrual of penalty and interest if mailed on or near a delinquency date. Consider taking your envelope inside to be postmarked same day.

View Account Details or Make a Payment ([link removed])

Beat the Wait!

Did you know you can check the line before you even leave your house? Our Live Wait Time Clock shows you exactly how long the queue is at every one of our locations in real-time.

Check Wait Times Here ([link removed])

New TxDMV Mandate: Updated Identification Standards

To ensure a smooth visit to the Tarrant County Tax Office, please double-check your identification before you arrive.

Please Note: These new identification standards for vehicle registration and title transfers are mandated by the Texas Department of Motor Vehicles (TxDMV) statewide. The Tarrant County Tax Office is required to implement these state-level changes. Call, email, or chat with us if you have any questions.

📞 817-884-1100

📧 [email protected] (mailto:[email protected])

Here is what you need to know to comply with the new TxDMV requirements:

1. Does your ID have the Star? Most customers will need an unexpired REAL ID compliant license or identification card. Check the top right corner of your card for one of these symbols:

* Gold Star

* Black Star

* Star inside a Gold or Black Circle

* Note: California IDs may show a Bear with a Star; Maine IDs may show the State Outline with a Star; and "Enhanced IDs" from WA, MI, NY, or VT may show an American Flag.

2. Other Acceptable Forms of ID If you do not have a REAL ID driver’s license, you may also present:

* Passports: Unexpired U.S. Passport, U.S. Passport Card, or a Foreign Passport.

+ Important: Foreign passports must be accompanied by a valid unexpired U.S. Visa (must read "IMMIGRANT VISA") or a Permanent Resident Card.

* Military: Unexpired U.S. Military ID, NATO ID, or ID issued under a Status of Forces Agreement.

* Handgun License: Unexpired Texas License to Carry (LTC/CHL).

3. What is NOT Accepted? Please do not bring the following as your primary identification for title or registration:

* IDs that are not REAL ID Compliant

* Employment Authorization Cards

* City Identification Cards

* Border Crossing Cards (B1/B2 Visas)

* International Driver's Licenses

4. Good News & Exceptions You do not need to meet these strict REAL ID requirements for the following transactions:

* Title Only transactions

* Replacement Plates or Stickers

* Address Changes

* Adding/Removing a Lienholder

* Obtaining a Disabled Person Placard

* Obtaining a Temporary Permit

5. Buying with a Co-Owner? If you are adding another person to the title, both parties must provide a compliant ID. If the co-owner cannot be present, you must have a clear copy or photo of their compliant ID to proceed.

** Skip the line: Renew your vehicle registration online!

------------------------------------------------------------

Registration renewal doesn’t have to be a chore. Instead of driving to one of our county offices, you can now renew your vehicle registration in minutes using Texas by Texas (TxT)—the official, secure digital assistant for the State of Texas.

Why renew online?

* Instant Confirmation: Receive an immediate digital payment receipt.

* Highly Secure: Your data is protected by the state's official digital platform.

* Convenient: Renew from your phone or computer, 24/7.

* Tracking: Easily track the status of your sticker delivery.

Ready to get started? Visit the official TxDMV portal by following the link using the button labeled "Vehicle Registration" below.

Vehicle Registration ([link removed])

Follow Us on Social Media where we share news and events as they happen. See employee spotlights, helpful tips, news, and more.

[link removed]

[link removed]

[link removed]

mailto:[email protected]

[link removed]

Bringing heart to service, and excellence to everything we do.

View email in browser ([link removed])

Tarrant County Tax Office . 100 E Weatherford St . Fort Worth, TX 76196-0206 . USA

DON’T FORGET TO UPDATE YOUR PREFERENCES!

update your preferences ([link removed]) or unsubscribe ([link removed])

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp