Email

Tax freedom day, and lessons for Alberta's new Heritage Fund Opportunities Corporation

| From | Fraser Institute <[email protected]> |

| Subject | Tax freedom day, and lessons for Alberta's new Heritage Fund Opportunities Corporation |

| Date | June 7, 2025 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email. Commentary and Blog Posts This Sunday, June 8, is Tax Freedom Day, when Canadians finally start working for themselves [[link removed]]

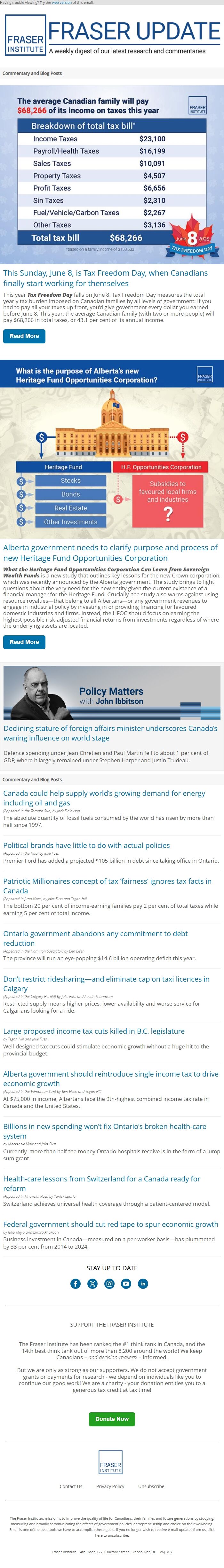

This year Tax Freedom Day falls on June 8. Tax Freedom Day measures the total yearly tax burden imposed on Canadian families by all levels of government: If you had to pay all your taxes up front, you’d give government every dollar you earned before June 8. This year, the average Canadian family (with two or more people) will pay $68,266 in total taxes, or 43.1 per cent of its annual income.

Read More [[link removed]] Alberta government needs to clarify purpose and process of new Heritage Fund Opportunities Corporation [[link removed]]

What the Heritage Fund Opportunities Corporation Can Learn from Sovereign Wealth Funds is a new study that outlines key lessons for the new Crown corporation, which was recently announced by the Alberta government. The study brings to light questions about the very need for the new entity given the current existence of a financial manager for the Heritage Fund. Crucially, the study also warns against using resource royalties—that belong to all Albertans—or any government revenues to engage in industrial policy by investing in or providing financing for favoured domestic industries and firms. Instead, the HFOC should focus on earning the highest-possible risk-adjusted financial returns from investments regardless of where the underlying assets are located.

Read More [[link removed]] Declining stature of foreign affairs minister underscores Canada’s waning influence on world stage [[link removed]]

Defence spending under Jean Chretien and Paul Martin fell to about 1 per cent of GDP, where it largely remained under Stephen Harper and Justin Trudeau.

Commentary and Blog Posts Canada could help supply world’s growing demand for energy including oil and gas [[link removed]] (Appeared in the Toronto Sun) by Jock Finlayson

The absolute quantity of fossil fuels consumed by the world has risen by more than half since 1997.

Political brands have little to do with actual policies [[link removed]] (Appeared in the Hub) by Jake Fuss

Premier Ford has added a projected $105 billion in debt since taking office in Ontario.

Patriotic Millionaires concept of tax ‘fairness’ ignores tax facts in Canada [[link removed]] (Appeared in Juno News) by Jake Fuss and Tegan Hill

The bottom 20 per cent of income-earning families pay 2 per cent of total taxes while earning 5 per cent of total income.

Ontario government abandons any commitment to debt reduction [[link removed]] (Appeared in the Hamilton Spectator) by Ben Eisen

The province will run an eye-popping $14.6 billion operating deficit this year.

Don’t restrict ridesharing—and eliminate cap on taxi licences in Calgary [[link removed]] (Appeared in the Calgary Herald) by Jake Fuss and Austin Thompson

Restricted supply means higher prices, lower availability and worse service for Calgarians looking for a ride.

Large proposed income tax cuts killed in B.C. legislature [[link removed]] by Tegan Hill and Jake Fuss

Well-designed tax cuts could stimulate economic growth without a huge hit to the provincial budget.

Alberta government should reintroduce single income tax to drive economic growth [[link removed]] (Appeared in the Edmonton Sun) by Ben Eisen and Tegan Hill

At $75,000 in income, Albertans face the 9th-highest combined income tax rate in Canada and the United States.

Billions in new spending won’t fix Ontario’s broken health-care system [[link removed]] by Mackenzie Moir and Jake Fuss

Currently, more than half the money Ontario hospitals receive is in the form of a lump sum grant.

Health-care lessons from Switzerland for a Canada ready for reform [[link removed]] (Appeared in Financial Post) by Yanick Labrie

Switzerland achieves universal health coverage through a patient-centered model.

Federal government should cut red tape to spur economic growth [[link removed]] by Julio Mejía and Elmira Aliakbari

Business investment in Canada—measured on a per-worker basis—has plummeted by 33 per cent from 2014 to 2024.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

This year Tax Freedom Day falls on June 8. Tax Freedom Day measures the total yearly tax burden imposed on Canadian families by all levels of government: If you had to pay all your taxes up front, you’d give government every dollar you earned before June 8. This year, the average Canadian family (with two or more people) will pay $68,266 in total taxes, or 43.1 per cent of its annual income.

Read More [[link removed]] Alberta government needs to clarify purpose and process of new Heritage Fund Opportunities Corporation [[link removed]]

What the Heritage Fund Opportunities Corporation Can Learn from Sovereign Wealth Funds is a new study that outlines key lessons for the new Crown corporation, which was recently announced by the Alberta government. The study brings to light questions about the very need for the new entity given the current existence of a financial manager for the Heritage Fund. Crucially, the study also warns against using resource royalties—that belong to all Albertans—or any government revenues to engage in industrial policy by investing in or providing financing for favoured domestic industries and firms. Instead, the HFOC should focus on earning the highest-possible risk-adjusted financial returns from investments regardless of where the underlying assets are located.

Read More [[link removed]] Declining stature of foreign affairs minister underscores Canada’s waning influence on world stage [[link removed]]

Defence spending under Jean Chretien and Paul Martin fell to about 1 per cent of GDP, where it largely remained under Stephen Harper and Justin Trudeau.

Commentary and Blog Posts Canada could help supply world’s growing demand for energy including oil and gas [[link removed]] (Appeared in the Toronto Sun) by Jock Finlayson

The absolute quantity of fossil fuels consumed by the world has risen by more than half since 1997.

Political brands have little to do with actual policies [[link removed]] (Appeared in the Hub) by Jake Fuss

Premier Ford has added a projected $105 billion in debt since taking office in Ontario.

Patriotic Millionaires concept of tax ‘fairness’ ignores tax facts in Canada [[link removed]] (Appeared in Juno News) by Jake Fuss and Tegan Hill

The bottom 20 per cent of income-earning families pay 2 per cent of total taxes while earning 5 per cent of total income.

Ontario government abandons any commitment to debt reduction [[link removed]] (Appeared in the Hamilton Spectator) by Ben Eisen

The province will run an eye-popping $14.6 billion operating deficit this year.

Don’t restrict ridesharing—and eliminate cap on taxi licences in Calgary [[link removed]] (Appeared in the Calgary Herald) by Jake Fuss and Austin Thompson

Restricted supply means higher prices, lower availability and worse service for Calgarians looking for a ride.

Large proposed income tax cuts killed in B.C. legislature [[link removed]] by Tegan Hill and Jake Fuss

Well-designed tax cuts could stimulate economic growth without a huge hit to the provincial budget.

Alberta government should reintroduce single income tax to drive economic growth [[link removed]] (Appeared in the Edmonton Sun) by Ben Eisen and Tegan Hill

At $75,000 in income, Albertans face the 9th-highest combined income tax rate in Canada and the United States.

Billions in new spending won’t fix Ontario’s broken health-care system [[link removed]] by Mackenzie Moir and Jake Fuss

Currently, more than half the money Ontario hospitals receive is in the form of a lump sum grant.

Health-care lessons from Switzerland for a Canada ready for reform [[link removed]] (Appeared in Financial Post) by Yanick Labrie

Switzerland achieves universal health coverage through a patient-centered model.

Federal government should cut red tape to spur economic growth [[link removed]] by Julio Mejía and Elmira Aliakbari

Business investment in Canada—measured on a per-worker basis—has plummeted by 33 per cent from 2014 to 2024.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor