| From | Urban Institute External Affairs <[email protected]> |

| Subject | The decline in federal spending on children |

| Date | May 15, 2025 7:42 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Greetings—

Tax credits and safety net programs for families improve children’s education, health, and employment outcomes. They also decrease reliance on public programs in the long term.

[link removed]

In a new fact sheet, Urban Institute researchers find that federal investments in children will not keep pace with economic growth, and that decline will be more severe if Congress enacts the spending cuts in the House of Representatives’ FY 2025 budget resolution.

[link removed]

They find that:

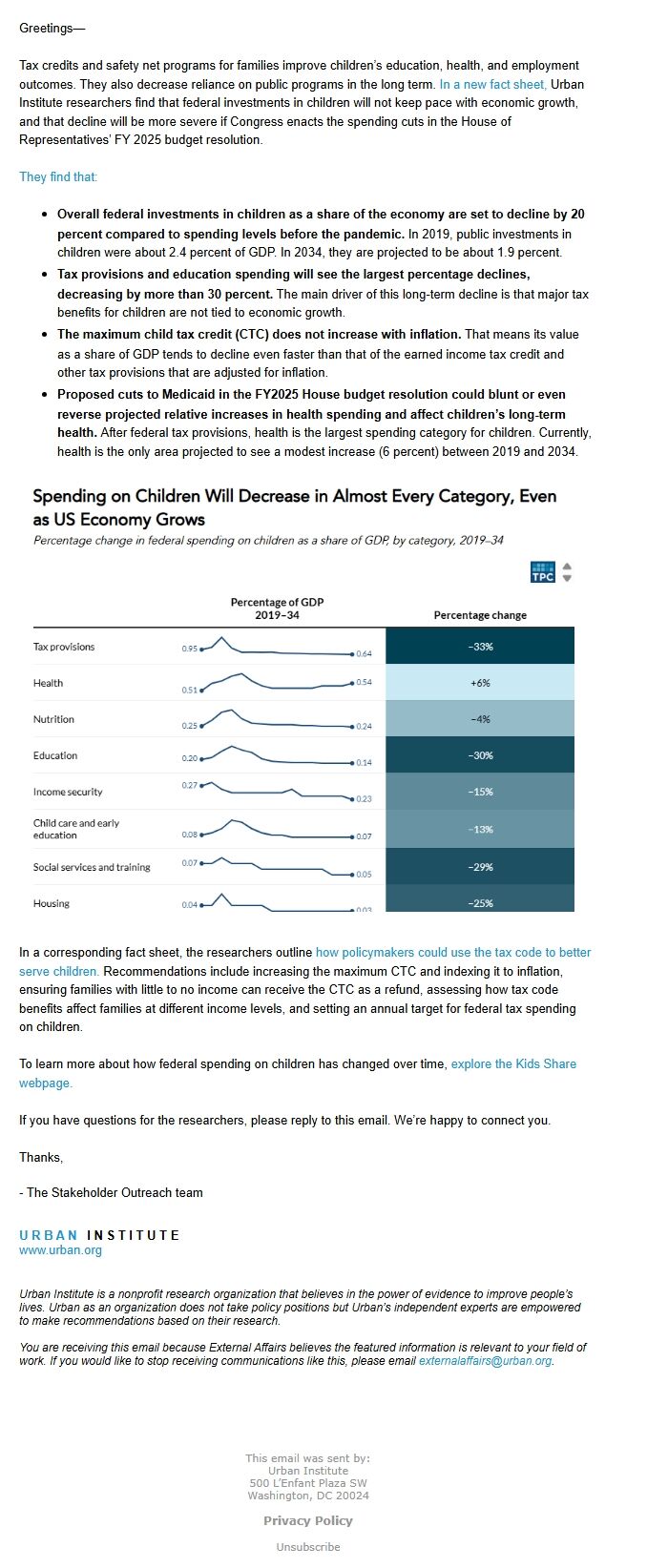

- Overall federal investments in children as a share of the economy are set to decline by 20 percent compared to spending levels before the pandemic. In 2019, public investments in children were about 2.4 percent of GDP. In 2034, they are projected to be about 1.9 percent.

- Tax provisions and education spending will see the largest percentage declines, decreasing by more than 30 percent. The main driver of this long-term decline is that major tax benefits for children are not tied to economic growth.

- The maximum child tax credit (CTC) does not increase with inflation. That means its value as a share of GDP tends to decline even faster than that of the earned income tax credit and other tax provisions that are adjusted for inflation.

- Proposed cuts to Medicaid in the FY2025 House budget resolution could blunt or even reverse projected relative increases in health spending and affect children’s long-term health. After federal tax provisions, health is the largest spending category for children. Currently, health is the only area projected to see a modest increase (6 percent) between 2019 and 2034.

[link removed]

In a corresponding fact sheet, the researchers outline

[link removed]

how policymakers could use the tax code to better serve children. Recommendations include increasing the maximum CTC and indexing it to inflation, ensuring families with little to no income can receive the CTC as a refund, assessing how tax code benefits affect families at different income levels, and setting an annual target for federal tax spending on children.

To learn more about how federal spending on children has changed over time,

[link removed]

explore the Kids Share webpage.

If you have questions for the researchers, please reply to this email. We’re happy to connect you.

Thanks,

- The Stakeholder Outreach team

U R B A N I N S T I T U T E

[link removed]

www.urban.org

Urban Institute is a nonprofit research organization that believes in the power of evidence to improve people’s lives. Urban as an organization does not take policy positions but Urban’s independent experts are empowered to make recommendations based on their research.

You are receiving this email because External Affairs believes the featured information is relevant to your field of work. If you would like to stop receiving communications like this, please email

mailto:[email protected]?subject=Please remove me from External Affairs communications

[email protected] .

----------------------------------------

This email was sent by: Urban Institute

500 L’Enfant Plaza SW,

Washington, DC, 20024

Privacy Policy: [link removed]

Update Profile: [link removed]

Manage Subscriptions: [link removed]

Unsubscribe: [link removed]

Tax credits and safety net programs for families improve children’s education, health, and employment outcomes. They also decrease reliance on public programs in the long term.

[link removed]

In a new fact sheet, Urban Institute researchers find that federal investments in children will not keep pace with economic growth, and that decline will be more severe if Congress enacts the spending cuts in the House of Representatives’ FY 2025 budget resolution.

[link removed]

They find that:

- Overall federal investments in children as a share of the economy are set to decline by 20 percent compared to spending levels before the pandemic. In 2019, public investments in children were about 2.4 percent of GDP. In 2034, they are projected to be about 1.9 percent.

- Tax provisions and education spending will see the largest percentage declines, decreasing by more than 30 percent. The main driver of this long-term decline is that major tax benefits for children are not tied to economic growth.

- The maximum child tax credit (CTC) does not increase with inflation. That means its value as a share of GDP tends to decline even faster than that of the earned income tax credit and other tax provisions that are adjusted for inflation.

- Proposed cuts to Medicaid in the FY2025 House budget resolution could blunt or even reverse projected relative increases in health spending and affect children’s long-term health. After federal tax provisions, health is the largest spending category for children. Currently, health is the only area projected to see a modest increase (6 percent) between 2019 and 2034.

[link removed]

In a corresponding fact sheet, the researchers outline

[link removed]

how policymakers could use the tax code to better serve children. Recommendations include increasing the maximum CTC and indexing it to inflation, ensuring families with little to no income can receive the CTC as a refund, assessing how tax code benefits affect families at different income levels, and setting an annual target for federal tax spending on children.

To learn more about how federal spending on children has changed over time,

[link removed]

explore the Kids Share webpage.

If you have questions for the researchers, please reply to this email. We’re happy to connect you.

Thanks,

- The Stakeholder Outreach team

U R B A N I N S T I T U T E

[link removed]

www.urban.org

Urban Institute is a nonprofit research organization that believes in the power of evidence to improve people’s lives. Urban as an organization does not take policy positions but Urban’s independent experts are empowered to make recommendations based on their research.

You are receiving this email because External Affairs believes the featured information is relevant to your field of work. If you would like to stop receiving communications like this, please email

mailto:[email protected]?subject=Please remove me from External Affairs communications

[email protected] .

----------------------------------------

This email was sent by: Urban Institute

500 L’Enfant Plaza SW,

Washington, DC, 20024

Privacy Policy: [link removed]

Update Profile: [link removed]

Manage Subscriptions: [link removed]

Unsubscribe: [link removed]

Message Analysis

- Sender: Urban Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Salesforce Email Studio (ExactTarget)