| From | Minnesota Department of Revenue <[email protected]> |

| Subject | Tax Professional Tip #16 – Preparer Data Breaches |

| Date | April 17, 2025 6:51 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax professionals

*QUICK REMINDER:* Now that the filing deadline has passed, please remember your responsibility as a Minnesota taxpayer to file your own return and pay your own tax in a timely manner. While your clients’ returns are important, your return is just as important.

We are all responsible for protecting customer data from theft. To provide guidance on data security, the IRS and Security Summit partners updated the Taxes-Security-Together Checklist [ [link removed] ]. For details, see Minnesota Department of Revenue’s “Protecting You and Your Clients from Fraud” attachment.

*What do I need to do?*

Fraudsters may try to access your computer systems and change bank account information after you start a tax return but before it’s filed. Verify your client’s bank information on their return before sending it.

*How can I prevent a data breach?*

* Think twice before you open links in emails or respond to requests for information.

* Make sure client data is always secure, including stored data.

* Require strong passwords—with letters, numbers, and symbols—on all computers and tax software programs.

* Use caution when granting remote access to your systems.

* Safeguard your Electronic Filing Identification Number (EFIN).

*What should I do if I suspect a data breach?*

Alert the IRS [ [link removed] ] and state agencies in every state you prepare returns.

To report a data breach to Revenue, call us at 651-296-3781 or 1-800-652-9094. We will review your clients’ accounts to determine if the data breach affected their state tax filings.

If your clients experience identity theft, have them visit our Identity Theft and Tax Refund Fraud webpage [ [link removed] ] to learn what they should do.

*Will Revenue notify me if my client data was breached? *

We may contact you if we suspect you or your clients have been victims of identity theft. If you are unsure if our contact is legitimate, call 651-556-3000 and ask for the person who contacted you.

*How do I report tax evasion, fraud, or other tax crimes?*

Visit our Tax Evasion and Fraud page [ [link removed] ] to fill out a report or for our contact information. You may also report phishing and online scams to the IRS. [ [link removed] ]

*Questions?*

Contact us.

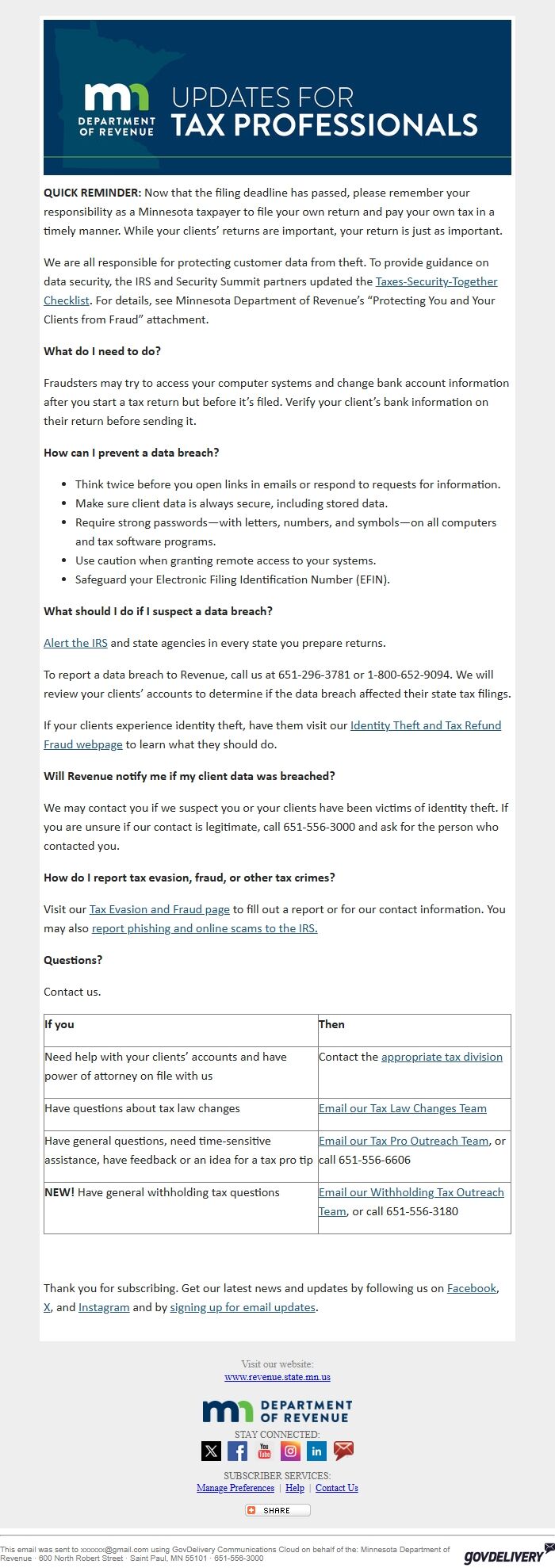

*If you*

*Then*

Need help with your clients’ accounts and have power of attorney on file with us

Contact the appropriate tax division [ [link removed] ]

Have questions about tax law changes

Email our Tax Law Changes Team <[email protected]>

Have general questions, need time-sensitive assistance, have feedback or an idea for a tax pro tip

Email our Tax Pro Outreach Team <[email protected]>, or call 651-556-6606

*NEW!* Have general withholding tax questions

Email our Withholding Tax Outreach Team <[email protected]>, or call 651-556-3180

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ], X [ [link removed] ], and Instagram [ [link removed] ] and by signing up for email updates [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Instagram [ [link removed] ] LinkedIn [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ] | Help [ [link removed] ] | Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue · 600 North Robert Street · Saint Paul, MN 55101 · 651-556-3000 GovDelivery logo [ [link removed] ]

*QUICK REMINDER:* Now that the filing deadline has passed, please remember your responsibility as a Minnesota taxpayer to file your own return and pay your own tax in a timely manner. While your clients’ returns are important, your return is just as important.

We are all responsible for protecting customer data from theft. To provide guidance on data security, the IRS and Security Summit partners updated the Taxes-Security-Together Checklist [ [link removed] ]. For details, see Minnesota Department of Revenue’s “Protecting You and Your Clients from Fraud” attachment.

*What do I need to do?*

Fraudsters may try to access your computer systems and change bank account information after you start a tax return but before it’s filed. Verify your client’s bank information on their return before sending it.

*How can I prevent a data breach?*

* Think twice before you open links in emails or respond to requests for information.

* Make sure client data is always secure, including stored data.

* Require strong passwords—with letters, numbers, and symbols—on all computers and tax software programs.

* Use caution when granting remote access to your systems.

* Safeguard your Electronic Filing Identification Number (EFIN).

*What should I do if I suspect a data breach?*

Alert the IRS [ [link removed] ] and state agencies in every state you prepare returns.

To report a data breach to Revenue, call us at 651-296-3781 or 1-800-652-9094. We will review your clients’ accounts to determine if the data breach affected their state tax filings.

If your clients experience identity theft, have them visit our Identity Theft and Tax Refund Fraud webpage [ [link removed] ] to learn what they should do.

*Will Revenue notify me if my client data was breached? *

We may contact you if we suspect you or your clients have been victims of identity theft. If you are unsure if our contact is legitimate, call 651-556-3000 and ask for the person who contacted you.

*How do I report tax evasion, fraud, or other tax crimes?*

Visit our Tax Evasion and Fraud page [ [link removed] ] to fill out a report or for our contact information. You may also report phishing and online scams to the IRS. [ [link removed] ]

*Questions?*

Contact us.

*If you*

*Then*

Need help with your clients’ accounts and have power of attorney on file with us

Contact the appropriate tax division [ [link removed] ]

Have questions about tax law changes

Email our Tax Law Changes Team <[email protected]>

Have general questions, need time-sensitive assistance, have feedback or an idea for a tax pro tip

Email our Tax Pro Outreach Team <[email protected]>, or call 651-556-6606

*NEW!* Have general withholding tax questions

Email our Withholding Tax Outreach Team <[email protected]>, or call 651-556-3180

Thank you for subscribing. Get our latest news and updates by following us on Facebook [ [link removed] ], X [ [link removed] ], and Instagram [ [link removed] ] and by signing up for email updates [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Instagram [ [link removed] ] LinkedIn [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ] | Help [ [link removed] ] | Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue · 600 North Robert Street · Saint Paul, MN 55101 · 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery