Email

Tax Tip 2023-77: Tax Pros: Register now for the 2023 IRS Nationwide Tax Forums as early registration rate expires June 15

| From | Internal Revenue Service (IRS) <[email protected]> |

| Subject | Tax Tip 2023-77: Tax Pros: Register now for the 2023 IRS Nationwide Tax Forums as early registration rate expires June 15 |

| Date | June 7, 2023 5:18 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

IRS Tax Tips June 7, 2023

Useful Links:

IRS.gov [ [link removed] ]

Help For Hurricane Victims [ [link removed] ]

________________________________________________________________________

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia?Center [ [link removed] ]

Noticias en Espa?ol [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams/Consumer Alerts [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact?Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact?Your Local IRS?Office [ [link removed] ]

Filing Your Taxes [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

?

________________________________________________________________________

Issue Number:?Tax Tip 2023-77

________________________________________________________________________

*Tax Pros: Register now for the 2023 IRS Nationwide Tax Forums as early registration rate expires June 15*

Back in person and better than ever -- registration is now open [ [link removed] ] for all five IRS Nationwide Tax Forums. Tax pros can get the lastest on changes to tax law, tax hot topics and IRS transformation efforts. This year?s forums offer attendees more than 40 seminars [ [link removed] ] for which tax pros can earn up to 18 continuing education credits.

*Registration details

*Attendees who register by the June 15 early bird deadline can take advantage of the lowest rate at $245 per person. That is a savings of $54 off the standard rate and $135 off the on-site registration price. Standard pricing begins June 15 and ends two weeks before the start of each forum. Members of participating associations can save an additional $10 off the early bird rate if they register by June 15.

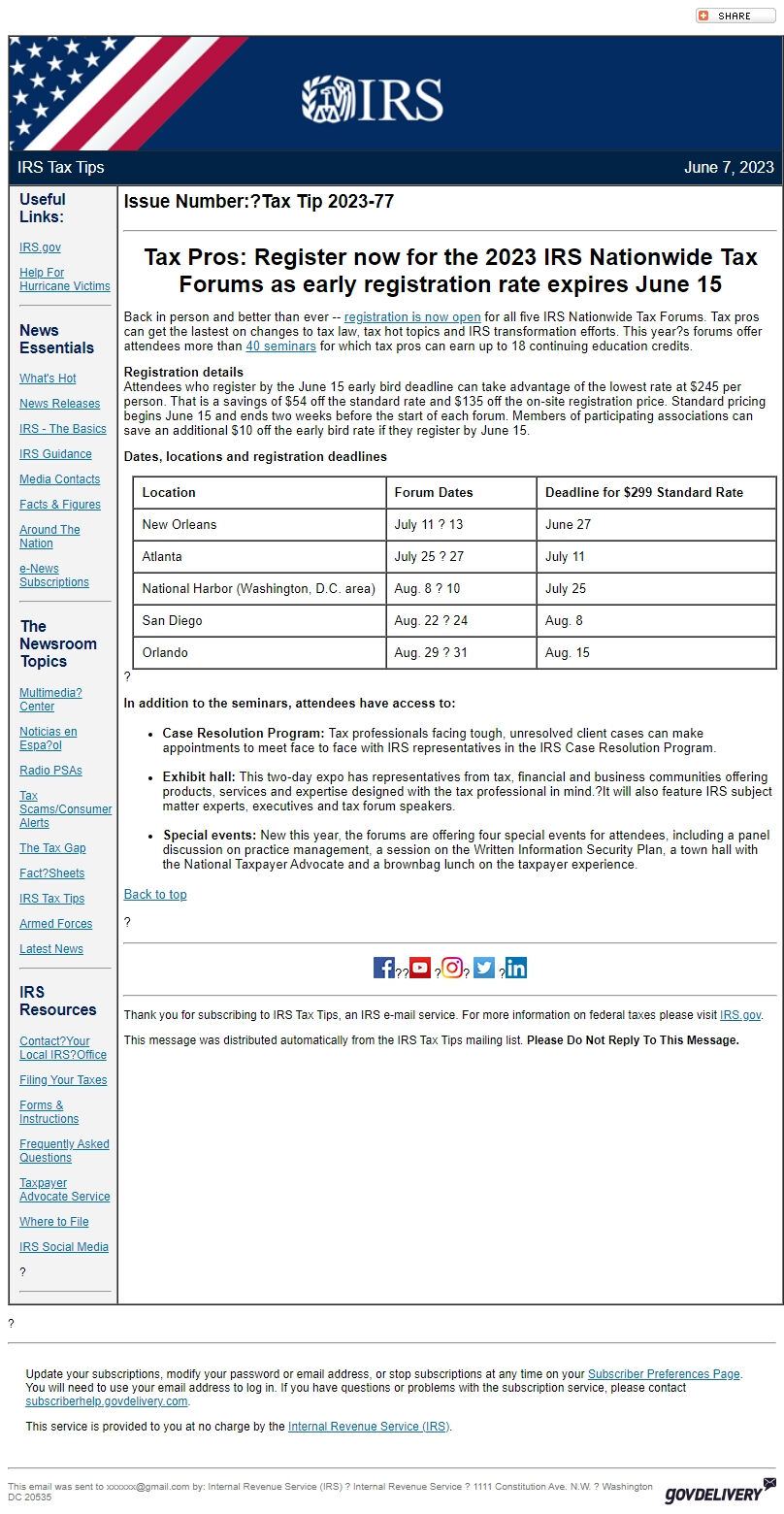

*Dates, locations and registration deadlines*

*Location*

*Forum Dates*

*Deadline for $299 Standard Rate*

New Orleans

July 11 ? 13

June 27

Atlanta

July 25 ? 27

July 11

National Harbor (Washington, D.C. area)

Aug. 8 ? 10

July 25

San Diego

Aug. 22 ? 24

Aug. 8

Orlando

Aug. 29 ? 31

Aug. 15

?

*In addition to the seminars, attendees have access to: *

* *Case Resolution Program: *Tax professionals facing tough, unresolved client cases can make appointments to meet face to face with IRS representatives in the IRS Case Resolution Program.

* *Exhibit hall:* This two-day expo has representatives from tax, financial and business communities offering products, services and expertise designed with the tax professional in mind.?It will also feature IRS subject matter experts, executives and tax forum speakers.

* *Special events: *New this year, the forums are offering four special events for attendees, including a panel discussion on practice management, a session on the Written Information Security Plan, a town hall with the National Taxpayer Advocate and a brownbag lunch on the taxpayer experience.

Back to top [ #top ]

?

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to IRS Tax Tips, an IRS e-mail service. For more information on federal taxes please visit IRS.gov [ [link removed] ].

This message was distributed automatically from the IRS Tax Tips mailing list. *Please Do Not Reply To This Message.*

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

IRS Tax Tips June 7, 2023

Useful Links:

IRS.gov [ [link removed] ]

Help For Hurricane Victims [ [link removed] ]

________________________________________________________________________

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia?Center [ [link removed] ]

Noticias en Espa?ol [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams/Consumer Alerts [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact?Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact?Your Local IRS?Office [ [link removed] ]

Filing Your Taxes [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

?

________________________________________________________________________

Issue Number:?Tax Tip 2023-77

________________________________________________________________________

*Tax Pros: Register now for the 2023 IRS Nationwide Tax Forums as early registration rate expires June 15*

Back in person and better than ever -- registration is now open [ [link removed] ] for all five IRS Nationwide Tax Forums. Tax pros can get the lastest on changes to tax law, tax hot topics and IRS transformation efforts. This year?s forums offer attendees more than 40 seminars [ [link removed] ] for which tax pros can earn up to 18 continuing education credits.

*Registration details

*Attendees who register by the June 15 early bird deadline can take advantage of the lowest rate at $245 per person. That is a savings of $54 off the standard rate and $135 off the on-site registration price. Standard pricing begins June 15 and ends two weeks before the start of each forum. Members of participating associations can save an additional $10 off the early bird rate if they register by June 15.

*Dates, locations and registration deadlines*

*Location*

*Forum Dates*

*Deadline for $299 Standard Rate*

New Orleans

July 11 ? 13

June 27

Atlanta

July 25 ? 27

July 11

National Harbor (Washington, D.C. area)

Aug. 8 ? 10

July 25

San Diego

Aug. 22 ? 24

Aug. 8

Orlando

Aug. 29 ? 31

Aug. 15

?

*In addition to the seminars, attendees have access to: *

* *Case Resolution Program: *Tax professionals facing tough, unresolved client cases can make appointments to meet face to face with IRS representatives in the IRS Case Resolution Program.

* *Exhibit hall:* This two-day expo has representatives from tax, financial and business communities offering products, services and expertise designed with the tax professional in mind.?It will also feature IRS subject matter experts, executives and tax forum speakers.

* *Special events: *New this year, the forums are offering four special events for attendees, including a panel discussion on practice management, a session on the Written Information Security Plan, a town hall with the National Taxpayer Advocate and a brownbag lunch on the taxpayer experience.

Back to top [ #top ]

?

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to IRS Tax Tips, an IRS e-mail service. For more information on federal taxes please visit IRS.gov [ [link removed] ].

This message was distributed automatically from the IRS Tax Tips mailing list. *Please Do Not Reply To This Message.*

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery