| From | Badger Institute <[email protected]> |

| Subject | Top Picks: Funding the future of Beloit’s young scholars 🎥 |

| Date | May 12, 2023 11:02 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

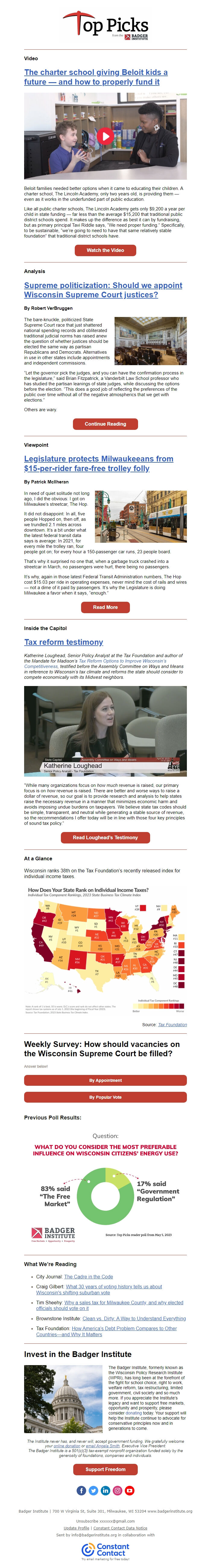

Supreme politicization, trolley folly, tax reform testimony Video The charter school giving Beloit kids a future — and how to properly fund it Beloit families needed better options when it came to educating their children. A charter school, The Lincoln Academy, only two years old, is providing them — even as it works in the underfunded part of public education. Like all public charter schools, The Lincoln Academy gets only $9,200 a year per child in state funding — far less than the average $15,200 that traditional public district schools spend. It makes up the difference as best it can by fundraising, but as primary principal Tavi Riddle says, “We need proper funding.” Specifically, to be sustainable, “we’re going to need to have that same relatively stable foundation” that traditional district schools have. Watch the Video Analysis Supreme politicization: Should we appoint Wisconsin Supreme Court justices? By Robert VerBruggen The bare-knuckle, politicized State Supreme Court race that just shattered national spending records and obliterated traditional judicial norms has raised anew the question of whether justices should be elected the same way as partisan Republicans and Democrats. Alternatives in use in other states include appointments and independent commissions. “Let the governor pick the judges, and you can have the confirmation process in the legislature,” said Brian Fitzpatrick, a Vanderbilt Law School professor who has studied the partisan leanings of state judges, while discussing the options before the election. “This does a good job of reflecting the preferences of the public over time without all of the negative atmospherics that we get with elections.” Others are wary. Continue Reading Viewpoint Legislature protects Milwaukeeans from $15-per-rider fare-free trolley folly By Patrick McIlheran In need of quiet solitude not long ago, I did the obvious: I got on Milwaukee’s streetcar, The Hop. It did not disappoint: In all, five people Hopped on, then off, as we trundled 2.1 miles across downtown. It’s a bit under what the latest federal transit data says is average: In 2021, for every mile the trolley ran, four people got on; for every hour a 150-passenger car runs, 23 people board. That’s why it surprised no one that, when a garbage truck crashed into a streetcar in March, no passengers were hurt, there being no passengers. It’s why, again in those latest Federal Transit Administration numbers, The Hop cost $15.03 per ride in operating expenses, never mind the cost of rails and wires — not a dime of it paid by passengers. It’s why the Legislature is doing Milwaukee a favor when it says, “enough.” Read More Inside the Capitol Tax reform testimony Katherine Loughead, Senior Policy Analyst at the Tax Foundation and author of the Mandate for Madison’s Tax Reform Options to Improve Wisconsin’s Competitiveness, testified before the Assembly Committee on Ways and Means in reference to Wisconsin’s tax climate and reforms the state should consider to compete economically with its Midwest neighbors. “While many organizations focus on how much revenue is raised, our primary focus is on how revenue is raised. There are better and worse ways to raise a dollar of revenue, so our goal is to provide research and analysis to help states raise the necessary revenue in a manner that minimizes economic harm and avoids imposing undue burdens on taxpayers. We believe state tax codes should be simple, transparent, and neutral while generating a stable source of revenue, so the recommendations I offer today will be in line with those four key principles of sound tax policy.” Read Loughead’s Testimony At a Glance Wisconsin ranks 38th on the Tax Foundation’s recently released index for individual income taxes. Source: Tax Foundation Weekly Survey: How should vacancies on the Wisconsin Supreme Court be filled? Answer below! By Appointment By Popular Vote Previous Poll Results: What We’re Reading City Journal: The Cadre in the Code Craig Gilbert: What 30 years of voting history tells us about Wisconsin's shifting suburban vote Tim Sheehy: Why a sales tax for Milwaukee County, and why elected officials should vote on it Brownstone Institute: Clean vs. Dirty: A Way to Understand Everything Tax Foundation: How America’s Debt Problem Compares to Other Countries—and Why It Matters Invest in the Badger Institute The Badger Institute, formerly known as the Wisconsin Policy Research Institute (WPRI), has long been at the forefront of the fight for school choice, right to work, welfare reform, tax restructuring, limited government, civil society and so much more. If you appreciate the Institute’s legacy and want to support free markets, opportunity and prosperity, please consider donating today. Your support will help the Institute continue to advocate for conservative principles now and in generations to come. The Institute never has, and never will, accept government funding. We gratefully welcome your online donation or email Angela Smith, Executive Vice President. The Badger Institute is a 501(c)(3) tax-exempt nonprofit organization funded solely by the generosity of foundations, companies and individuals. Support Freedom Badger Institute | 700 W Virginia St, Suite 301, Milwaukee, WI 53204 www.badgerinstitute.org Unsubscribe [email protected] Update Profile | Constant Contact Data Notice Sent by [email protected] in collaboration with Try email marketing for free today!

Message Analysis

- Sender: Badger Institute

- Political Party: n/a

- Country: United States

- State/Locality: Wisconsin

- Office: n/a

-

Email Providers:

- Constant Contact